How app development addresses the challenges of the insurance industry

Introduction to the Insurance Industry’s Digital Challenges

Today we will discuss app development in the insurance industry because this market is undergoing a significant transformation, initiated by technological advancements and changing customer expectations that influence many industries. Knowing the possibilities the tech can bring them, customers demand services that are reliable accessible, personalized, and user-friendly. However, insurance companies face several pain points that delay their ability to meet these demands effectively:

Poor Digital Experience

Many customers report frustration with the digital interfaces of their insurance providers. Websites and apps are often not user-friendly, difficult to navigate, or lack the functionality that allows customers to manage their policies, file claims, or access support easily. And a poor digital experience leads to dissatisfaction, impacting customer retention and brand perception (which are crucial in the insurance industry).

Inefficient Claims Processing

The process of filing and processing claims is traditionally slow and fraught with bureaucratic hurdles, leading to delays and a lack of transparency. Customers find themselves stuck in a loop of paperwork and long waiting periods, causing significant distress and dissatisfaction at a time when they are already dealing with potentially stressful situations.

Lack of Personalization

In an era where personalized experiences are becoming the norm, the one-size-fits-all approach no longer suffices. Customers expect insurance products and services tailored to their specific needs and situations. However, many insurance providers struggle with processing customer data effectively to offer personalized experiences. As a result, they’re missing out on opportunities to elevate customer loyalty and engagement.

High Operational Costs

The insurance sector is burdened by high operational costs, a significant portion of which is due to outdated and inefficient processes. These include manual data entry, paper-based documentation, and legacy IT systems that are costly to maintain and slow to adapt to changing market demands.

Competition from Insurtechs

The rise of Insurtechs — technology-driven startups that offer innovative insurance solutions — poses a significant threat to traditional insurers. These newcomers are often more agile, leveraging the latest technologies to offer superior customer experiences, more personalized services, and efficient operations. To stay competitive, traditional insurers must innovate and adapt to these changing dynamics.

Addressing these pain points is, to be honest, crucial for staying competitive. But it’s also about transforming the very way insurance companies operate and engage with their customers, to fulfil their needs and requirements (arising with the global technology development). In the following sections, we’ll explore how app development, particularly with React and React Native, can provide the solutions needed to overcome these industry challenges.

Want to resolve those issues with app development?

Improving Digital Experience with User-Friendly Apps

The digital landscape for the UK insurance sector presents a mixed picture of innovation and frustration among customers. Data reveals a significant amount of customer dissatisfaction arises from digital experiences with their insurers’ products. Negative feedback was mostly related to the operational aspects of insurers’ digital platforms, including website navigation, app and website downtime, and suboptimal network speeds.

React and React Native offer compelling solutions for the challenges lined with the user experience of digital platforms. They provide strong ecosystems for developing intuitive and user-friendly mobile and web applications. The flexibility and efficiency of React’s component-based architecture allow for the creation of dynamic user interfaces that are both responsive and engaging.

Meanwhile, React Native enables developers to build mobile apps that feel truly native to both iOS and Android platforms using a single codebase. It streamlines development processes but also ensures consistency in user experience across different devices and platforms.

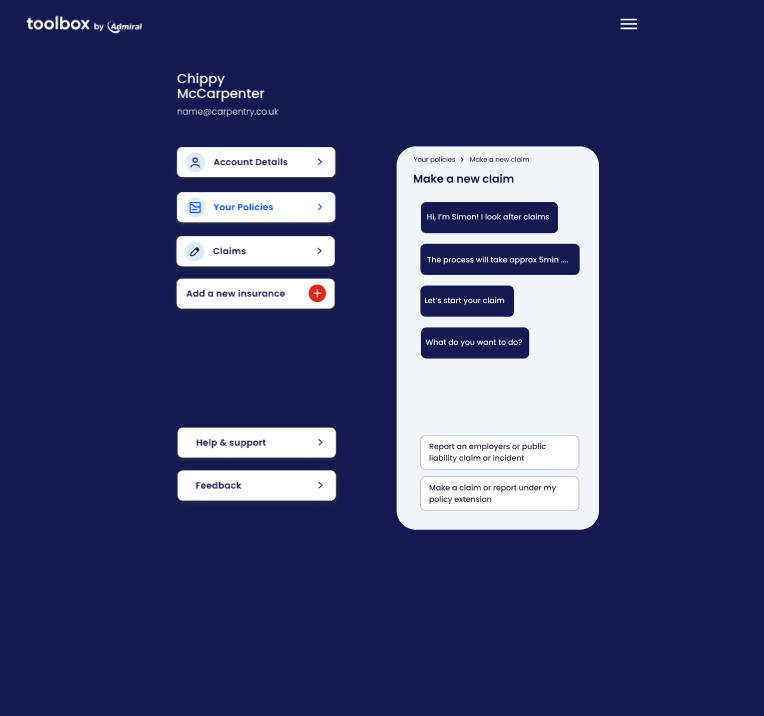

A real-world example of using these technologies to improve the digital experience is the Toolbox by Admiral project we finished last year. Faced with the challenge of unifying user experiences across various insurance products, Toolbox was looking for a modern technological solution.

The existing tools were implemented on separate PAS systems, each following different user journeys, which fragmented the customer experience. The decision to use Sanity CMS, which is built with React, was crucial for achieving seamless integration across the platform’s components. This choice led to the adoption of React.JS for frontend development, thanks to its compatibility with Sanity and the smooth user experience it offers.

Furthermore, the project aimed to create a marketing website that ranks highly on search engines and provides outstanding performance to its users. The adoption of Jamstack met these requirements by separating the front end from the back end, thus elevating the website’s performance, flexibility, and scalability. Next.JS (a framework built upon React) was selected as the frontend framework, aligning perfectly with the chosen tech stack and contributing to the site’s excellent performance and user experience.

Streamlining Claims Processing

The insurance claims process is notoriously slow and inefficient, often characterized by manual data entry, extensive paperwork, and a lack of transparent communication. These inefficiencies can delay claims resolutions, leading to customer disaffection and increased operational costs for insurers. Customers today expect a swift, hassle-free claims process, something traditional methods fail to deliver.

React JS and React Native enable the creation of dynamic, responsive user interfaces, making it easier for customers to submit claims, track their status, and communicate with insurance providers. But the benefits extend far beyond just UI improvements:

- Seamless Third-Party Integrations: React’s ecosystem includes extensive libraries and frameworks that enable easy integration with third-party services such as databases, authentication systems, and AI-powered analytics tools. This allows for the automation of claims processing, from initial submission to final resolution, greatly reducing processing times.

- Real-Time Data Processing: With React, applications can handle real-time data processing and updates, improving the efficiency of claims management. Insurers can quickly gather, analyze, and respond to claim submissions, streamlining decision-making processes.

- Improved Data Accuracy and Security: React applications can connect to secure, cloud-based databases and employ real-time validation techniques to ensure the accuracy of claims data. This minimizes errors and fraud risks, upgrading the overall security of the claims process.

- Customizable Workflow Automation: React’s flexibility allows for the development of customized workflows, enabling insurers to automate various stages of the claims process according to their specific needs. This could include automated document verification, claim assessment through AI, and instant communication updates to customers.

- Scalability and Performance: React and React Native are designed for high performance and scalability, ensuring that claims processing systems can handle high volumes of claims without compromising on speed or user experience. This is crucial for insurers facing peak times or looking to expand their customer base.

Personalizing Customer Experiences with Data Analytics

Today, personalization is key to better customer engagement and higher loyalty. The insurance industry, traditionally reliant on a one-size-fits-all approach, faces the challenge of meeting the growing expectations for tailored products and services. A shift towards personalization requires a deep understanding of customer data and user behaviour. However, many insurers find themselves struggling to do this. And as a result, missing crucial opportunities to connect with their customers on a more personal level.

The development of the “Quote to Buy” and “Customer Account” applications for the Toolbox by Admiral project demonstrates how React and its ecosystem can help overcome these challenges.

These applications were built using Create React App, a client-side rendering tool optimized for delivering personalized content. CSR is great for applications that require personalized user experiences, as it can dynamically generate content for each user. This ensures that users receive a customized experience.

TOOLBOX CASE STUDY

Check how we’ve built a user friendly web platform for the UK’s insurance provider

READ CASE STUDY

React’s ability to integrate with various data sources and third-party services allows for the efficient handling and analysis of customer data. And thanks to that we can build features that adapt to the individual preferences and behaviours of users. And further boosting the overall user experience.

Furthermore, React’s component-based architecture encourages the reuse of UI components, making it easier and faster to develop and maintain applications that offer personalized experiences. This modularity ensures that developers can quickly iterate and deploy new features or adjustments based on user feedback or data analysis, keeping the applications up-to-date with customer needs and preferences.

Reducing Operational Costs with App Automation and Optimization

Operational costs in the insurance industry are significantly high, primarily due to outdated processes, manual tasks, and the maintenance of legacy systems. These inefficiencies drain the resources but also hinder the ability to offer competitive services. However, React and React Native present a promising way to mitigate these costs through technological innovation and strategic application development.

Streamlined Deployment and Hosting

Using React’s ecosystem in the project, including Next.js for web applications, allows for optimal hosting solutions such as serverless functions or static site generation. This can substantially lower hosting expenses by using modern cloud technologies that scale based on demand. Thanks to that insurers pay only for the resources they actually use, avoiding the overhead associated with traditional hosting models.

Cross-Platform Efficiency

With React Native we can simply create cross-platform mobile apps that perform on both iOS and Android from a single codebase. This capability drastically cuts down the development and maintenance costs typically associated with creating and managing separate apps for each platform (and hiring two various teams). It streamlines the deployment process, accelerates time to market, and simplifies updates, providing a consistent user experience across all devices.

VEYGO CASE STUDY

Check how we’ve built a React Native MVP for insurance industry provider in just 6 weeks

READ CASE STUDY

Cost-effective development with Code Reusability

React and React Native’s component-based architecture enables developers to reuse code across web and mobile platforms, further reducing development time and costs. This reusability extends to various libraries within the React ecosystem, allowing developers to implement features such as navigation, state management, and form handling more efficiently. By avoiding the need to develop the same functionality twice, insurers can allocate their resources more effectively, focusing on innovation and user experience improvements.

Access to Open-Source Libraries for Accelerated Development

The React ecosystem is rich with open-source libraries and tools that simplify the development process. These resources enable rapid prototyping and development, reducing the time and cost associated with bringing new features to market. Additionally, the active and supportive React community provides invaluable resources for solving common development challenges, further speeding up the development cycle.

Staying Competitive against Insurtechs with Innovative App Solutions

The insurance industry is increasingly influenced by the rise of Insurtechs, technology-driven startups that challenge traditional insurance models with innovative solutions. These companies are focused on agility and digital-first approaches. For traditional insurance companies, the key to remaining competitive lies in adopting innovation and modern technology to enrich their offerings.

To seize the opportunities and overcome

Source: Digital disruption in insurance: Cutting through the noise

the threats implicit in digital disruption,

incumbents have no choice but to

innovate

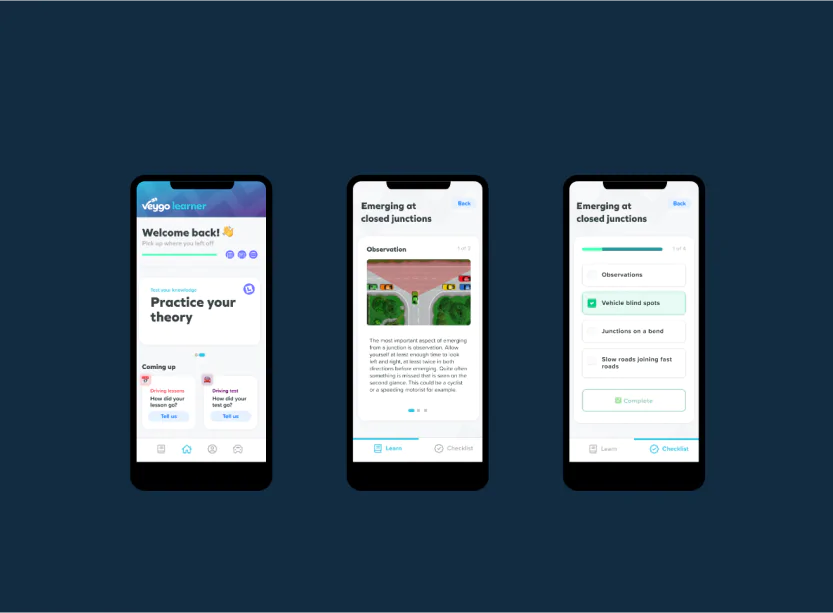

Pagepro’s collaboration with Veygo, a team from Admiral Group company, is a great example of how insurance providers can use technology to stay ahead the competitors. They reached us looking for a partner to build a mobile app MVP (Minimum Viable Product) that will work on various platforms. Of course, we used React Native to bring the project from concept to launch in just 6 weeks. It’s a great demonstration of React Native’s capacity for quick iterations. And how it enables to test and validate new business ideas with minimal upfront investment and time.

React Native allows developers to write code once and deploy it across both iOS and Android platforms, reducing development time and costs. It is valuable among the competition in the Insurtech environment, where the ability to quickly adapt and respond to market changes is a huge competitive advantage.

By adopting React Native and other modern development practices, traditional insurers can significantly shorten their innovation cycles. It allows them to explore new business models, services, and customer engagement strategies with reduced risk and investment.

Summary

Addressing the customer’s pain points is the key to successful business cooperation – everyone knows that. In the insurance industry, the customer’s loyalty is important too, so answering the client’s needs is at the heart of their operation. The companies can do that by creating a user-friendly web and mobile app that streamlines the user experience and enables internal process automation. Choosing the right tech stack, like React and React native can make a break the success of the product.

We think it’s time to abandon legacy systems and take a course on the modern digital era.

Ready to build your new React app?

Read More

The Best React Native Tech Stack for a New Mobile App in 2024

Best React js Tech Stack in 2024

How to Take Care of Data Security in React Native?

Migration to React Native from PWA

Navigating complex projects with a React agency

Sources:

- https://www.pwc.co.uk/press-room/press-releases/poor-digital-experience-a-pain-point-for-some-uk-insurance-custo.html

- https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/time%20for%20insurance%20companies%20to%20face%20digital%20reality/digital-disruption-in-insurance.ashx

- https://www.elsewhen.com/blog/how-leading-insurtechs-are-solving-customer-pain-points/